POSITIONING MATRIX [-5/+5]

USD -3 //

EUR +1 //

JPY -2 //

CHF +2 //

GBP -2 //

AUD +3 //

NZD +2 //

CAD -1 //

NOK +1 //

SEK +3 //

ZAR +4 //

MXN +1 //

TRY +4 //

POSITIONING MATRIX [-5/+5] USD -3 // EUR +1 // JPY -2 // CHF +2 // GBP -2 // AUD +3 // NZD +2 // CAD -1 // NOK +1 // SEK +3 // ZAR +4 // MXN +1 // TRY +4 //

Round Two

[18/12/25] [T]

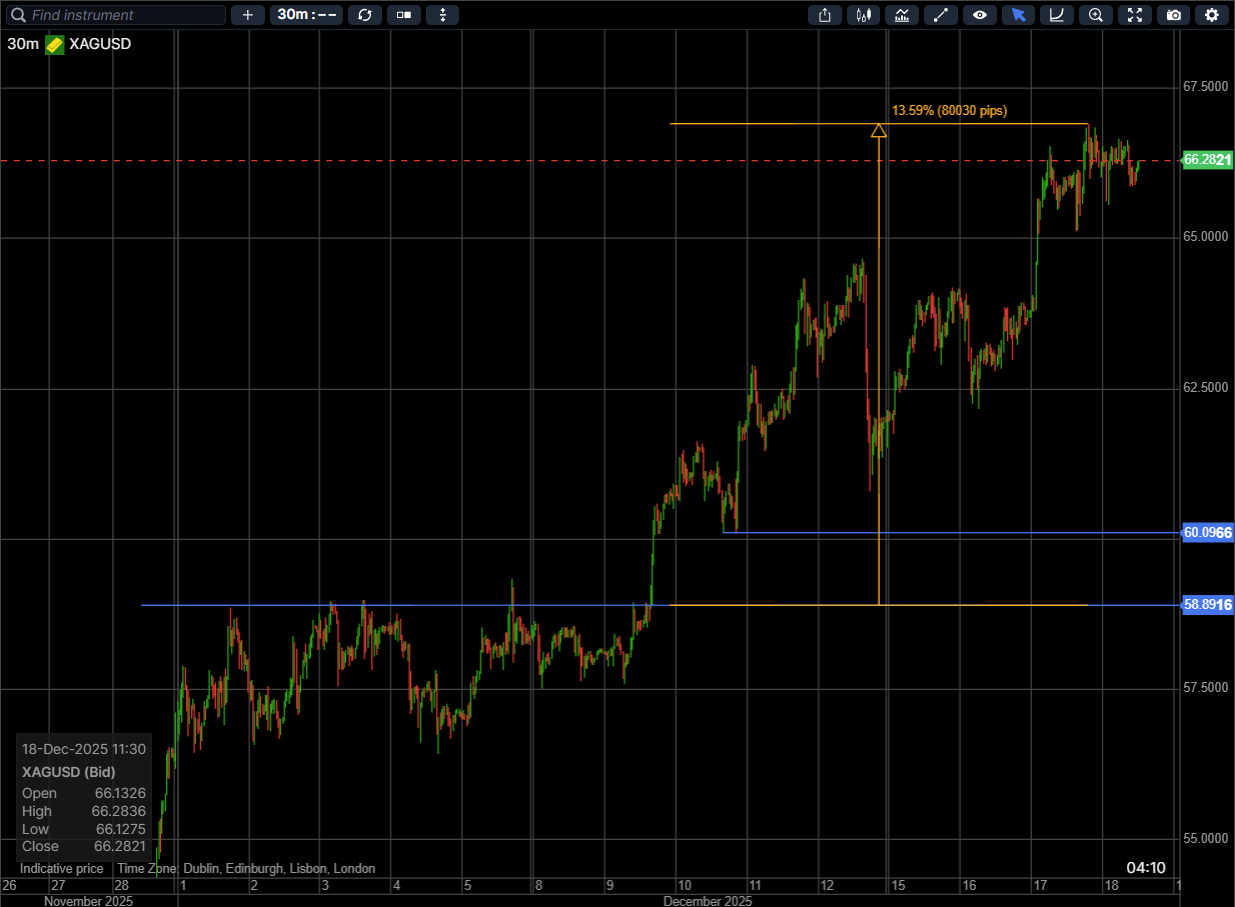

Since covering the silver short on Dec 5th, it has rallied a further 13.5%, taking it to +100% YTD. Astonishing stats - with the XAU parabolic comparables a little more digestible given it’s reserve status than XAG’s speculative/industrial properties. I spent yesterday curious as to why this runaway move was happening on a session during which US equities were suffering and some of the FX short USD ‘darlings’ were seeing a sharp unwind, catalysed originally by Trump’s EU tariff comments and hinting at broader deleveraging ahead of the US CPI print. I was hoping to see some degree of consolidation in XAG and before missing the train; I am going to call both an APAC & LDN session without a breach of the prior NY extremes just that. It’s a brave trade to short XAGUSD and this is nothing structural, but I feel there is good asymmetry to the view into the data, considering risk of a hot print and the standing start vs the dislocation with the other debasement basket trades yesterday - at least those that aren’t rates/steepener expressions (long SPX, short USD, long metals). Selling XAGUSD ahead of the NY open here (model/systematic open behind us and profit-taking into the looming US CPI event risk screening as good risk reward, as was seen through the sharp Friday PM sell-off).

Trade expression of choice:

Selling XAGUSD in 50% size at 66.30 with a 67.50 S/L. T/P at 63.00 Risking 1.8% to make 5%. (Beneath 65.00, where the futures volume accelerated yesterday, trail stop to entry)

Update [18/12/25]

TP on 50% of position pre-US CPI at 65.75. S/L on balance over data 66.85 yesterday’s high (synthesizes S/L @ entry)

Update [18/12/25]

Close position (balance at 65.40) on US cash equity open as earlier CPI print invalidates the catch-down logic above. Might be leaving money on the table, but feeling like the recalibration might be complete without the CPI beat.

Perennial bear

[17/12/25]

No call to action yet - will update below. Putting my thoughts on CHF out there, as I have been bearish for some time now, with the currency largely rangebound since starting this venture four months ago (EURCHF 0.9200-0.9450 for the most-part), but have not managed to make money in the phases of CHF weakness. Hoping it helps someone form a view.

Fully aware and sympathetic to the concept of CHF being ‘FX gold’. Geopolitical neutrality since the dawn of time and structurally low inflation are a potent combo. The phrase “victim of it’s own success” comes to mind when considering that through decades of policy stability and asset-steadiness (we don’t need to mention the morning of Jan 15, 2015), the attractiveness of the CHF despite any relative yield whatsoever has resulted in its strength undermining the competitiveness of Swiss exports. It is an open economy, after all, with pharmaceuticals and luxury goods making up a large component of its export basket. All said; at some point, the strength in the CHF is either a problem for the central bank or the corporate sector. CHF strength is great for those working in Switzerland and living/spending in neighbouring countries, yet this is increasingly an issue for the primary income balance of the country.

In the FX world, the CHF is used to fund carry/EM expressions at times, but when the toolkit for funders has included the JPY, EUR and CNH (in order of preference) in recent years, that CHF pressure has not sustained to the same degree.

The SNB have two weapons to placate or combat said strength and they are refreshingly open about it. They can A) lower interest rates and use forward guidance to suppress the curve, or B) intervene directly in the FX market to counter episodic strength in the franc. My view is that A) is harder when you’re at 0% and negative rates have a strong psychological economic impact, and harder still when your G10/DM peers are ending their own cutting cycles (see recent front-end pricing step function). It is agreeable that if the SNB start cutting, they can go aggressively negative, but we are not there now. The SNB report their (B) activity, but it is lagged nuanced, as well as difficult to reverse engineer their sight deposit data. It has been happening this year but in a far more passive style than previously. The read-through of this activity is that for now the SNB prefer EURCHF above 0.92 than below, but are not actively pressuring the franc; instead absorbing stressed buying of the CCY during episodes of global equity correction.

In the very short-term, EURCHF correlates positively with Russia-Ukraine news-flow. The bar was arguably high for a surprise out of the SNB last week, but they failed to clear it and the CCY responded positively. Dips to a 0.92 handle in EURCHF have been elusive, but I am growing more confident that the usual month/year end CHF strength can this year create a structural entry opportunity, in limited loss format, to take advantage of the tailwinds of Q1.

Medium-term bullish EURCHF thesis:

EZ fiscal-spend harvest underway. Hard data to pick-up as we approach the 1Y anniversary of the spend. Global equity projections higher into H1.

Russia-Ukraine ceasefire would see a CHF haven premium removed, as well as EZ restructuring benefit.

Vol-selling structures compress prices; when the range breaks (0.9200-9450) you have the SNB on one side and runaway potential on the other as market-makers struggle for liquidity.

Carry (ZAR, latam) popular with carry:vol ratios high and 2026 TOTY features rife. JPY funder status cemented post Takaichi but JPY shorts extended and BOJ hurdle through Dec-Jan to clear.

You benefit from a c.2% carry buffer being long EURCHF - ideally embedded into the FXO price as opposed to a naked cash long.

AUDJPY structural

[09/12/25]

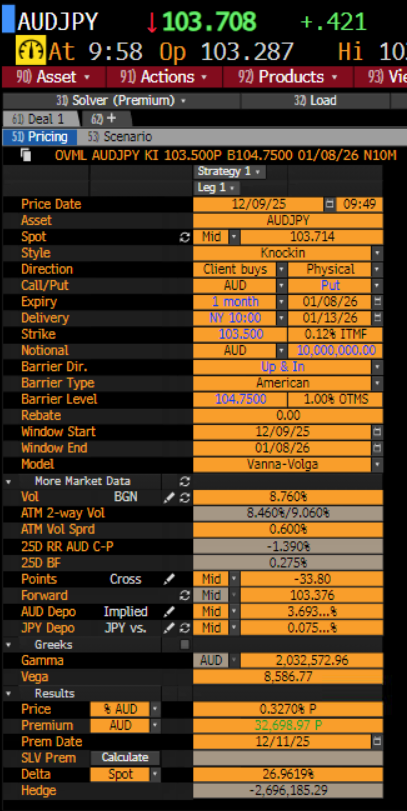

‘Think macro; trade micro’ was the thesis behind the two-day cash AUDJPY short that worked well last week. Recency bias and trend channel break aside, I think the JPY side of the macro analysis is becoming very attractive at these levels (I won’t repeat) and that FX volatility is about to increase. The biggest development in financial markets, for me, in the last week is the repricing in the front-end rates/bond markets of many of the ‘smaller’ open economies. AU, NZ and CA especially. Although the CA reprice is more aggressive, I want to focus on AU. As illustrated below, when priced on Nov20th the market had c.14bp of RBA cuts by May next year; before the OCR reverted to current by Dec. We now price almost a whole 25bp hike by May and 47bp of hikes by Dec!! A remarkable tightening. It can be argued that this is for good reason, given the data, commentator (WSJ) rhetoric and the language re ‘26 hike door-opening by the RBA at the meeting last night, but I worry for the stability of other markets when you see this sort of tightening step-function. We’ve had a couple of ‘risk wobbles’ of late that have been rescued by earnings and positive seasonality (equities in particular) and the continued rip higher in BCOM. Phase 1 of play here is that these factors should continue to support rotation into AUDXXX and carry, however phase 2 may well be that either earnings (ORCL weds) or the Fed inspire the pendulum to swing back towards fear, which would see a sharp risk unwind as reality dawns re the bond market moves. A hawkish cut is expected from the Fed, but the market base-case (Hassett) is to look through this and focus on the US divergence story in 2026 as the US curve displays very different characteristics during the period analysed. In my view. the biggest risk is that the US curve starts to do even a fraction of the same and we may then see a quick dash for ‘hedges’. I still think the USD will be a favoured short into 2026 so I am looking for non-USD expressions of this view. AUDJPY fits well, given its risk sensitivity over the latest US equity move. I want to be very careful with entry here (AUDNZD experience aside) as the RBA repricing is important and the CCY should benefit for a few more sessions. The reason for fading the move at this point is that A) its not an AU specific theme (JGB move is not new and 25bp in Dec is not relatively large, but the lesson is that these shifts can be parabolic if officially signaled) and B) the market is adding to AUDXXX exposure at a dangerous moment. Rather than wait (given proximity to the BOJ), I want to use what I think will be an increase in FX vol generally over the coming week as we catch up to rates, to buy a structure with a KI. Not betting the farm as I don’t want to give back the AUDJPY cash P&L.

Trade expression of choice:

Buying a 1m 103.50 AUDJPY put (SR 103.71) with a 104.75 KI in 50% size ($20k margin deployment)

Update [09/12/25]

Selling 2.5mio AUDJPY spot at 104.35 w/ stop through 104.75 (KI), risking $6.5k to flatten the long AUDJPY delta and hedge the option, given the spot move that is now underway c.7hr after buying the KI. Essentially increasing the margin allocation from $20k to $26.5k (max loss), but monetising the quick delta move since inception, should we correct into this week’s events. TP stays at 102.10, where we based twice last week before/whilst running the short cash position.

Update [15/12/25]

Lift 50% of AUDJPY cash hedge at 103.02. Bid for 50% remains at 102.10. Heavy event risk incoming.

Update [18/12/25]

Covering final 50% AUDJPY hedge at 102.80. Average exit 102.915.

Unwinding AUDJPY KI put for 20bp, as KI is now too far away going into the BOJ tonight. Convexity is lost unless MOF intervention succeeds a BOJ hold. Seems unlikely.

AUDJPY tactical

[04/12/25] [T]

While I continue to mull over the short USD exposure (it’s already popular with Hassett essentially confirmed, so managing FOMO is the main issue here), I think AUDJPY is setting up nicely for a short into the top of this seven month trend channel with a tight stop. People are getting lured into longs just as the macro stories and positioning are diverging, in my view. On the AUD side - GDP disappointed yesterday (inventory detraction especially), Bullock rescued the post-data clear-out with the ‘CPI pressures’ comment and we are just five days from the RBA meeting, forming a risk hurdle for fresh longs to get over… meanwhile the PBOC signal slowing appreciation with a marginally higher USDCNH fix. It is fair to say that tonight’s AU goods surplus data is impressive, but that should now be a known known (especially the gold exports uptick). The household spending beat should play second fiddle to yesterday’s GDP miss. All said, being long AUDUSD is no longer the obvious USD short it seemed two sessions ago, but still has merit and is pushing to fresh highs with the complex… but I think the easy money has been made and it’s tougher from here on a cross basis; plus my near-term view on precious metals is clear and correlated. On the JPY side of the equation I am sensing Dec 2024 repetition complacency. The assumption is that @80% priced, a BoJ hike would see USDJPY losses quickly faded and only a runaway topside USDJPY in the wake of the meeting would bring the MOF in to turn the trend. A fair comparison, but because of this template, I don’t think the JPY long exists and I do think they hike and momentum sustains as positions are cut slowly. In fact, given carry strategies retain their US government shutdown momentum, I would suggest the market is shorter JPY than we believe - not to mention the Ishiba/Takaichi/loose fiscal discount in the ccy. This early-days asymmetry that I am sensing can be traded now that the 102.50/55 zone that has capped previously and then 7x yesterday across 3 timezones (I’ve shown it in red on the second chart below) has impulsively broken in Asia. I like selling here at 102.80 this morning with a tight stop above 103.10. Beneath 102.45 and stop trails to entry/we let it run.

Trade expression of choice:

Short AUDJPY 102.80. Tight S/L 103.10.

Update [04/12/25]

TP on 50% of the short here (102.30). SL remains at 102.80 for the balance. Below 102 and I will trail that stop to the 102.55 pivot.

Update [05/12/25]

Closing the position on the London open (102.32). AUDUSD is breaking the pivot into 0.6625/30 and USDJPY is failing to follow-through on the 154.50/60 break of Monday’s spike low.

Silver Turkey

[29/11/25] [T]

As well as scribing only the structural, longer-term, often-optionalised trade ideas, I will start posting the shorter-term tactical [T] trade ideas, which are more often cash expressions and with much shorter horizons. Starting Jan ‘26, I will update a ‘carousel’ daily, with tradeable events, market dislocations and themes. This will give a more complete picture of overall trading activity for those wanting to follow along higher-touch.

Misery amongst the bears - not just the AI species - but most cross-asset products across the liquidity spectrum are ripping into month-end, A) invalidating many of the month-end portfolio rebalancing signals in the FX space and B) highlighting/exposing some serious liquidity issues as market-maker warehousing appetite is reduced over the holiday period and CTAs execute on signals nonetheless. A great example of this is the multi-sigma move in XAGUSD through the 54.40 double-top - with liquidity exacerbated by a CME ‘cooling outage’. As AI darlings, US indices and precious metals resume their parabolic trips north in tandem, I believe the latter is suffering from this Thanksgiving ‘liquidity breakage’, with a 6% low-high intraday move, likely continuing on the Monday open, but getting into snap-back territory as exhaustion is met by equilibrium. Whilst I don’t doubt the ultimate direction and the debasement theory more broadly, I think there is good asymmetry to start fading this move in anticipation for mean reversion as liquidity returns into next week. A low time-frame deployment on a strategy that should, over time, be high sharpe.

Trade expression of choice:

Sell XAGUSD 56.50-57.50. S/L 59.00. T/P 55.00 (just above the double-top and where I suspect buyers will now lurk). Risk 2.5% to make 4.0%. 50% usual size - volatility adjusted.

Update [02/12/25]

Following the 56.50 Monday open, the XAG 56.50>58.85>56.50 round trip in 24hrs leaves us short at 57.75 average, with the stop loss level confirmed at 59.00. Risking $125 to make $275+.

Update [02/12/25]

Cover 50% XAGUSD into the futures close (58.40). Bitcoin +7% (the positive correlation with XAG during the last AI deleveraging episode was a good bonus thesis for this trade, as crypto nosedived to begin the month, but the main view was for a quick liquidity correction of the Thanksgiving break) and the USD rally intraday (in the ccy space and in XAUUSD) not feeding through into the XAG illiquid gap-closure I had expected. 56.50 this morning felt excitable, but the daily 4%+ swings of late are an energy drain, albeit tradeable in small size. In G10, I am considering a core USD short trade over the turn of the year, which dovetails with this tactical position reduction. Not yet pulling the trigger, but prefer to be flat than have a USD short expression on at the moment. Happy to reduce the risk 50% and instead cancel the 55.00 TP on the balance; looking for a more ambitious pull-back should the 50% balance survive. 59.00 SL remains on 50%.

Update [05/12/25]

Stopped out of 50% balance of position at 59.00.

Flightless bird

[20/11/25]

The popular AUDNZD long has been resolving itself into something feeling more like equilibrium. A two-punch combo of a disappointing (in-line) NZ jobs print saw an illiquid 1.15 barrier breach and gap higher in the front tenors, followed by an impressive headline number out of the AU counterpart on Nov 13th, which formed the ‘blow-out-top’ seen on the chart below (1.1636 high); with AUDXXX punctured alongside AI/Tech in the sessions to follow.

I like the story here. Simplified: the summer divergence in AUD and NZD was built upon the outperformance of metals and miners, a global equity surge amidst peak ‘debasement’ euphoria and a clearly diverging (rhetoric & action) set of antipodean central banks, with the former quickest to complete its cutting cycle and enjoying a barrage of better hard data. This logic was entrenched at 1.10/12 and inducing FOMO at 1.14, yet seems to have dissipated as we consolidate near the highs, having cleansed FXO-related orderboards and with asymmetry around the up-coming NZ data releases and central bank language now shifting. Next Wednesday, we have the RBNZ. A 25bp cut to 2.25% is fully priced (34bp priced out to Feb). My feeling is that there is a potentially great set-up here to fade a rally in AUDNZD ahead of this meeting, with the recent data stabilisation and central bank language moderation to be digested by the market as a ‘hawkish cut’ (just as we had seen out of the BOC last month). The goal is to see c.5-7bp of cut pricing stripped back and for the ‘most shorted CTA ccy in G10 FX’ to rebound by 1-1.5%. We have AU Q3 GDP on Dec 3, hence I am hoping the lifespan of this trade is short and will keep targets sensible.

Trade expression of choice:

Offer AUDNZD @ 1.1590 (green). S/L 1.1675 (red). T/P 1.1410.

N.B. 50% of normal deployment size (i.e. 2% margin usage), given difficulty positioning in thematic FX through this US data-drought and the more tactical (NZ data release) nature of this trade.

Update [26/11/25]

Nailed the view; fumbled the trade! A 2.25% OCR but with a 2.20% terminal, accompanied by a namesake performance by Hawkesby. Cut pricing unwound and a 1% nosedive in AUDNZD (1.1407 low). A poor display on my part, being too ‘cute’ with entry and missing the move, despite calling it. Cancelling the orders as the asymmetry has flattened and moving on!

Fade the fracas

[29/10/25]

The long awaited OBR forecast leak in the form of this week’s FT article has led to a flurry of sell-side fiscal headroom recalculations and bearish GBP trade idea publications. The headlines read awfully, with the ‘hole’ shift from £20bn to potentially nearer £40bn and the IFS report that each 1pp productivity downgrade could have a £7bn 2029/30 PSNB impact both frankly terrifying.

My belief is that there is some information in the market reaction not beginning at FT publication time (7pm 27/10/25], nor aggressively on the gilt market open the following day, but instead later in the session. I think there are technicals at play - both in the traditional sense i.e. EURGBP breaking the many intraday/week highs into the 0.8750/75 band - but also the mechanics of the vol market, whereby much like EURCHF, the multi-month consolidation and vol RV activity has resulted in a barrier-related more impulsive move, as delta books scramble to adjust quicker than market-makers had hoped to be able to act, mixed with a spec market that had A) decayed out of its short GBP core delta during the stagnant summer and B) actually began buying DNTs in EURGBP in recent weeks. The extent to which the EURGBP25dRR has aggressively shifted for GBP puts in the past 36hr (+0.50>+0.80), as well as the high levels of interest reported by banks, support the break-out hype logic.

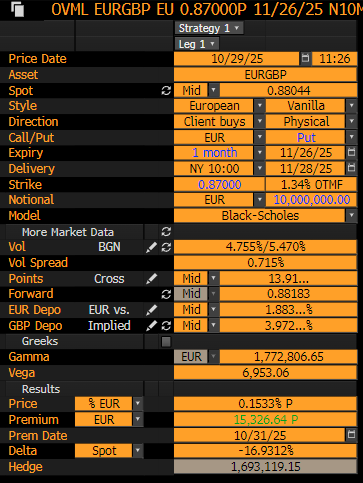

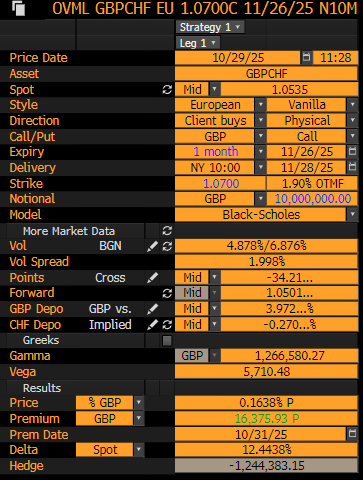

My foundational thinking has two pillars. Pillar 1: Labour are floating trial balloons, as has been evidenced over the past two months; often with fairly disastrous content, which should serve to ‘ready’ both the market and the electorate with the worst case scenario, ultimately seeing a phase of relief into/over the Autumn Budget. A lot of money was made in 2022 on the Liz Truss ‘bond vigilante’ CCY+FI weakness cocktail, with the market ultimately breaking, however I believe this is unlikely to repeat. Pillar 2: This play for a GBP break lower would make more sense in a ‘high beta’ and ‘carry-unraveling’ fast market. I doubt whether the conditions we witness as I type (i.e. continued EM frenzy, high carry:vol ratios, equity ATH series’ and a stabilisation in the metals rout that had VaR-shock potential) will propel the theme. In this world, in which AUD thrives, GBP is often also on the pro-cyclical podium. Put simply, I believe one month is a very long time to await the 26th Nov announcement, paying for the privilege to hold the risk and with an already high bar for negative surprise just moving higher.

The prudence of limiting risk-taking or portfolio build-out amidst the US data drought and market catalyst absence of course dovetails with a mean-reversion bias, which i recognise can be dangerous, if this is regime change and I am wrong. I will therefore express this view in optionalised, limit-loss format and diversifying the CCY-specific expression slightly.

Trade expressions of choice:

Basket of GBP length with 1m expiry capturing November budget date:

(50%) EURGBP (SR 0.8805) long 1m 0.87 put @ 0.15%

(50%) GBPCHF (SR 1.0535) long 1m 1.07 call @ 0.16%

Update [25/11/25]

Spent the day unwinding the GBPCHF 1.07 vanilla for an average of 25bp at SR 1.0652. The profit-taking is arriving late in GBPXXX but is warranted (and probably healthy for the structural multi-year shift lower), given how positioning had built into the event and the dislocation between the seemingly stretched CCY and some pretty nasty moves in gilts last week that would've usually seen aggressive accompanying GBP selling. Given that we have the EURGBP put into the event, happy to take the get-out-of-jail-free card in GBPCHF (1.0363 low during the AI meltdown!), as they become the same trade, the closer we have come to the UK budget, i.e. a relief delta. This outstanding (unhedged) EURGBP risk also supports the decision to sell a portion of this option, as opposed to trading the GBPCHF gamma, as the view (which remains) has always been for a GBP rally into/over the budget. Also feeding into the decision was my (GS endorsed, admittedly) opinion that the event weight was now too high for the event. Any gamma trading will only be done on a successful outcome: working a bid for 5mio EURGBP at 0.8700 and 5mio at 0.8625. Both feel ambitious!

Update [26/11/25]

EURGBP expires worthless. 0.8755 low.

Goldmember

[25/09/25]

Before you engage… this is about as contrarian as they come. I am well aware that it contrasts with the DNA of most readers.

XAUUSD is up 46% YTD. It is up 84% since the beginning of 2024. The DXY is down 5% over the same period. In the price increase is two persistent geopolitical tragedies, a de-dollarization/debasement trade of the soundest logic, aggressive and wide-spread openly-reported central bank reserve accumulation, an excitable CTA community lip-licking at the succession of trending highs culminating in the eye watering % gains aforementioned, as well as various metal-specific US tariff concerns that have stressed regional commodities exchanges and associated storage and logistics.

The most recent acceleration in demand, confirmed by the enormous growth in GCZ5 Dec XAU future open interest, has been the technical break-out through the 3,430 pivot depicted by the red line on the chart below, which chimed with the hasty rebuilding of the USD short trade in the FX space - responsible for much of the spec community’s YTD performance as it collapsed in April and had always been ear-marked to resume in Q3.

That USD trade, as detailed in the previous blog post [EURUSD update 17/09/25], is suffering somewhat. Pain is being inflicted across the board as the post-Fed range breaks failed and we slump back into a choppy regime, with carry:vol ratios high enough to again lure people into the darlings (ZAR, TRY). I sense that the most annoying of these USD reversals (i.e. those that were built reluctantly into/over the Fed and with more than a sprinkle of FOMO) are EURUSD longs and USDCNH shorts. Yesterday saw aggressive cutting of both.

All said, I am wondering if the XAU long - given this too has A) come an awful long way and B) is in the same grouping as EURUSD and USDCNH when tested for ‘addition at poor levels recently’ symptoms - is also vulnerable in coming sessions or weeks. In this market I suspect pain felt elsewhere may be funded by the winners - of which XAU is front of pack - and I worry that we do not have a fresh USD lower catalyst for some time now - outside of a US government shut-down, which is quickly on our radars but may be a severe enough VaR shock that it actually sees books collapsed and asset-shedding… i.e. the ultimate resolution may be a large deleveraging in US tech stocks/indices and XAU and XAG. I am therefore playing for a pull-back in XAUUSD, but in limited-loss format and with enough time in the lifespan of the trade to weather any initial volatility.

Trade expression of choice:

The cash trade would be: Short GCZ5 Dec25 Gold Future at 3785 (spot equivalent $3755t/oz) with a tight stop through the highs at 3840 ($3,810 spot equivalent). Risking 1.5% on the idea to make 8%, which will either work very well very quickly, or be stopped within a short timeframe!

I am however going to anticipate greater chop in the short-term and suspect that a 1.5% cash stop in a 16 vol ccy will become a regret. I also want more leverage as I believe the move will play out quickly (in %-terms) when it happens. I am therefore instead buying a 3m $3,450 digital XAUUSD put in 50% ‘normal’ notional for 12%. Expiry right around Xmas. A late profit-taking gift? The strike is just above the tech break, which is 8% beneath spot, but these options are expensive, with the OTM strike and favourable (3792) ATMF not doing much to make the 16 vol handle more palatable. Hopefully expensive for a reason - however sizing accordingly.

Thanks for reading!

Fair weather friends

[09/09/25]

Local politics have served as a distraction from the Fed independence/US exceptionalism/tariff roll-out themes through the summer. Be it Turkish CHP leadership/Indonesian Finance Minister removal, the Ishiba resignation in Japan, UK Labour misdemeanors/pre-budget reshuffle or the collapse of Bayrou’s government in France, the market has not been short of idiosyncratic themes to get its teeth into, whilst the ‘tier1’ theme stalls. ‘Fiscal dominance’ - not mutually exclusive from the above events - is a term used regularly and necessarily, given the rising back-end yields most developed economies are experiencing.

This week, following the Ishiba-inspired gap lower in the JPY on the Wellington open, market participants (who had spent Friday afternoon selling USDJPY into the 146.80/147.00 sticky zone) received a body-shot (>148.50), which I believe lessened appetite to sit long EURs into the Bayrou confidence vote and a potential Macron resignation gap during the past 24hrs. The JPY is now notably firming, with far less participation, as the event enters the rear-view and I suspect the EUR is now poised to breathe a similar sigh of relief. Even the pound is enjoying a brief reprieve as speculators realise we have a long wait until 26th Nov - yet another signal that political disarray doesn’t necessarily equate to currency destruction… yet.

We are of course not out of the woods from a French political standpoint, but this does not mean we cannot price-out some of this risk premium; ideally proxied and accompanied by a calming of fixed income spreads.

Although I have the EURXXX exposure in EURCHF, I have been sleeping on the idea of the short USD component that many already have on their roster. On the USD side of the equation, I had seen 25-28bp for the Sep Fed as fair if not mature and so had been waiting for either momentum resumption, a clear September ‘back to school’ story and/or US data confirmation. I think the US data confirmation arrived on Friday (I had expected a 25-50k headline to be clouded by a ‘better’ UR of 4.1%, which it wasn’t) and see this EURUSD trendline break depicted below as being an embryonic and liquid version of the development in the gold market of late. Rather, I am seeing decent asymmetry to play for the break here vs. the other USD selections in the G10 space, given what are now clearly defined levels to me. It is not a familiar experience to be engaging with something at the extremes, but I think the exception can be made to add a USD-lower component as I construct, given how powerful a driver it was through H1 and how under-owned I now sense this trade is. Should EURUSD reverse - whilst frustrating, I will be comfortable that it was a worthwhile play and one that would form the foundation of a USD lower basket, should the theme resume.

The clear risk in the short-term that can extinguish the view quickly is that today’s BLS revisions are not as negative as we expect, which could stifle the momentum as quickly as it had built, but I would prefer to establish the risk ahead of the release. On the US CPI front, I am happy that a hot print, given the Fed blackout, will see USD supply into any rally.

Trade expression of choice:

Long EURUSD (spot) 1.1750. S/L 50% 1.1650 (trendline relapse), 50% 1.1530 (100dMA pivot since Nov’24)

i.e. S/L average is 1.1590; risking 1.4% on the view

T/P 1.2100

Update [17/09/25]

Selling 50% of EURUSD long at 1.1850. S/L at average entry 1.1650 for the balance of 50%. Margin usage for this trade therefore reduced from 4% to 2%.

Crucially, I don't understand why the momentum has built in the 48hr pre-Fed, when we have had a series of what I had interpreted to be negative US data releases over the course of the prior week (PPI, CPI (Core PCE 0.18-0.20% read-through), IJC (Texas or otherwise), U.Mich, NFP revisions of c.900k and Empire Manufacturing), yet the USD had displayed absolutely no interest in following US rates nor taking direction from XAU. Ironically, a US retail sales beat coincided with the momentum resumption!

That said, be it FOMO/pre-meeting positioning or systematic flow driving the move, I believe it prudent to reduce the risk into this pre-Fed rally in EURUSD. I don't plan on 'actively' trading around the levels communicated on these longer-term ideas, but watching the moderation in AUD, XAU and ZAR pre-meeting, and recognising the macro data dislocation, I would like to adjust here. To cover the eventuality that this is indeed the USD break we have been waiting for, the TP on the balance will remain at 1.21.

For colour - examples of hawkish outcomes over the Fed on the radar:

- The use of the word ‘insurance’ accompanying a 25bp cut

- No adjustment in the ‘25 dot from 3.9 down to 3.6

- Powell playing-up labour supply issues and highlighting uncertainty on the b/e unemployment rate

- No lowering in PCE long-run projection from 3.1 (i.e. unchanged, despite CPI/PCE read-through mentioned above)

- Cook, still voting, ‘rebelling’ with a dissenting ‘hold’ alongside Schmidt (NB unlikely!!)

Good luck out there!

Update [26/09/25]

The remaining 50% of EURUSD balance stopped at 1.1650 yesterday evening. The cocktail of US curve flattening, improving US data and a cleanse in legacy USD shorts takes us out of the position. Happy with the risk management pre-FOMC and ultimately hold a longer-term USD bearish view, but respecting the price action and the trend-line break/levels.

Overall cost of trade (carry; as stopped at average entry) 9bp i.e. -0.09% on 2% margin usage

Goodbye, franc.

[21/08/25]

In a world that punishes central banks late to cut (Fed) and rewards those early in the cycle (ECB) from a currency standpoint, the swift and drastic lowering of the OCR by the Swiss National Bank to oh-so-familiar ‘zero bound’ territory has meant that the franc has thrived for the past 12 months (in fact, the past decade). The balancing act of lower local yields cementing the ‘funder’ status of the franc and the perennial need for market participants to view it as a haven (and to quickly ratchet up this exposure and happily pay the punitive carry during times of geopolitical disarray) has seen the latter win out. I view this balancing act - that has manifested in EURCHF coiling within a 0.9250/9450 range this summer - as being over. We now have two further weights on the CHF side of the scales:

A) The net effective U.S. tariff rate of c.18% (vs the terrifying 39% headline rate, assuming Pharma resolution in coming weeks and the continued exemption of gold tariffs)

B) The Trump-brokered ongoing Russia/Ukraine/Europe/US conversation, whilst difficult to track and harder to conclude, can see a sharp risk premium removal in EURCHF specifically. Both European restructuring multiplier effects and the direct impact of unfrozen Russian assets, which I suspect will benefit EUR more than it will benefit USD, gold and bitcoin, can see sustained EUR cross recovery.

It has been a while since negative domestic Swiss newsflow has been a driver of the currency. In fact, the last bout of sustained pressure on the franc and associated speculative activity was earlier in the cutting cycle through H1 2024. This low level of current positioning reinforces my view. Realised (thus implied) vol in XXXCHF is still incredibly low, and so the confluence of this view with the resultant well-defined spot levels in EURCHF, alongside cheaper option expressions in the other crosses is attractive. The kicker is that rate differentials in places are suggestive of a recalibration - see below CHFJPY chart of spot vs. the 6m forward rate - traditionally a better indicator of spot direction, yet recently diverging despite the SNB seemingly done with the OCR relapse and focusing on the FX intervention side of their mandate, whilst the BOJ face an entirely different issue of higher inflation, higher yields and perhaps the need to consequently embark upon an entirely unfamiliar hiking cycle themselves.

The risk is that I’m not identifying an early regime change, flagged by a 48hr U.S. tech stock/Reddit wall episode, or that I am underestimating the degree to which the market is pre-positioning for an end to the Russia/Ukraine conflict. That said; I’m expressing both in limited-loss format.

Trade expressions of choice (pricing references 8amLDN):

(50%) Long EURCHF spot 0.9370 (0.9600 T/P; 0.9270 S/L)

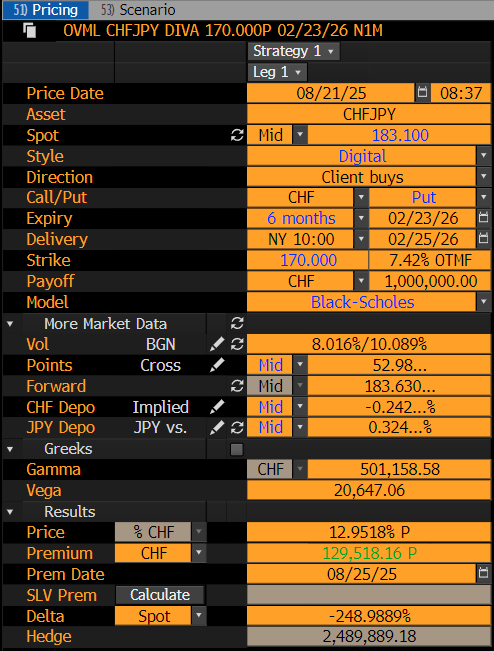

(50%) Long CHFJPY 6m 170 digital put @ 13% (spot reference 183.10)

Update [16/10/25]

EURCHF cash long stopped at 0.9270 in late London trading (again traded through the level on higher volume in Asia). Frustrating, given how resilient US equities have held-in during the NY time-zone and the beach-ball-esque price action beneath 0.93 once again. Given trade inception on 21/08/25, the position has benefited from -28pips of carry, improving the cash entry to 0.9342. The loss on the trade (allocated 2% of margin account) is therefore 0.77%. Keeping the CHFJPY digital and weathering the decay, given its Feb26 expiry and the even greater interest rate differential at current spot… although under no illusion that without the removal of Takaichi tail risk, this is unlikely to come back from the dead any time soon.

Elsewhere, happy to be taking it slow with the more structural ideas, given the macro uncertainty out there and the ongoing US data drought.

Update [12/11/25]

Unwind CHFJPY digital at 6%. Takaichi’s initial approval ratings surpass the backtested ‘new PM decay’ @ c.65%, she has not yet had to significantly dilute her fiscal promise and the BoJ’s independence remains in question, with no Dec BoJ leaks as of yet, nor anything other than MOF jawboning. Sensible to unwind this digital on the breach of the October highs in CHFJPY and key 154.50 resistance in USDJPY; from a capital preservation standpoint, if nothing else, as the view is stale. Loss on this portion of the trade is 53% of the premium spent i.e. -$10,600 in the Margin Account. The swap spread divergence remains but this is not a trade for now, clearly, ad was never intended to be a ‘wait for MOF intervention to get out of jail’ play.