AUDJPY structural

[09/12/25]

‘Think macro; trade micro’ was the thesis behind the two-day cash AUDJPY short that worked well last week. Recency bias and trend channel break aside, I think the JPY side of the macro analysis is becoming very attractive at these levels (I won’t repeat) and that FX volatility is about to increase. The biggest development in financial markets, for me, in the last week is the repricing in the front-end rates/bond markets of many of the ‘smaller’ open economies. AU, NZ and CA especially. Although the CA reprice is more aggressive, I want to focus on AU. As illustrated below, when priced on Nov20th the market had c.14bp of RBA cuts by May next year; before the OCR reverted to current by Dec. We now price almost a whole 25bp hike by May and 47bp of hikes by Dec!! A remarkable tightening. It can be argued that this is for good reason, given the data, commentator (WSJ) rhetoric and the language re ‘26 hike door-opening by the RBA at the meeting last night, but I worry for the stability of other markets when you see this sort of tightening step-function. We’ve had a couple of ‘risk wobbles’ of late that have been rescued by earnings and positive seasonality (equities in particular) and the continued rip higher in BCOM. Phase 1 of play here is that these factors should continue to support rotation into AUDXXX and carry, however phase 2 may well be that either earnings (ORCL weds) or the Fed inspire the pendulum to swing back towards fear, which would see a sharp risk unwind as reality dawns re the bond market moves. A hawkish cut is expected from the Fed, but the market base-case (Hassett) is to look through this and focus on the US divergence story in 2026 as the US curve displays very different characteristics during the period analysed. In my view. the biggest risk is that the US curve starts to do even a fraction of the same and we may then see a quick dash for ‘hedges’. I still think the USD will be a favoured short into 2026 so I am looking for non-USD expressions of this view. AUDJPY fits well, given its risk sensitivity over the latest US equity move. I want to be very careful with entry here (AUDNZD experience aside) as the RBA repricing is important and the CCY should benefit for a few more sessions. The reason for fading the move at this point is that A) its not an AU specific theme (JGB move is not new and 25bp in Dec is not relatively large, but the lesson is that these shifts can be parabolic if officially signaled) and B) the market is adding to AUDXXX exposure at a dangerous moment. Rather than wait (given proximity to the BOJ), I want to use what I think will be an increase in FX vol generally over the coming week as we catch up to rates, to buy a structure with a KI. Not betting the farm as I don’t want to give back the AUDJPY cash P&L.

Trade expression of choice:

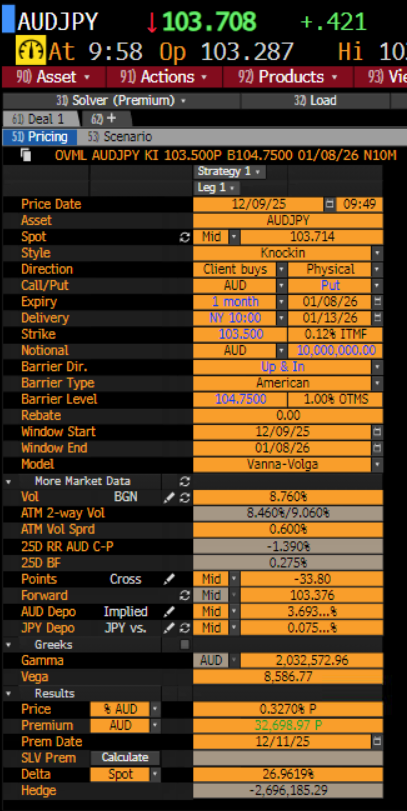

Buying a 1m 103.50 AUDJPY put (SR 103.71) with a 104.75 KI in 50% size ($20k margin deployment)

Update [09/12/25]

Selling 2.5mio AUDJPY spot at 104.35 w/ stop through 104.75 (KI), risking $6.5k to flatten the long AUDJPY delta and hedge the option, given the spot move that is now underway c.7hr after buying the KI. Essentially increasing the margin allocation from $20k to $26.5k (max loss), but monetising the quick delta move since inception, should we correct into this week’s events. TP stays at 102.10, where we based twice last week before/whilst running the short cash position.

Update [15/12/25]

Lift 50% of AUDJPY cash hedge at 103.02. Bid for 50% remains at 102.10. Heavy event risk incoming.

Update [18/12/25]

Covering final 50% AUDJPY hedge at 102.80. Average exit 102.915.

Unwinding AUDJPY KI put for 20bp, as KI is now too far away going into the BOJ tonight. Convexity is lost unless MOF intervention succeeds a BOJ hold. Seems unlikely.