Fade the fracas

[29/10/25]

The long awaited OBR forecast leak in the form of this week’s FT article has led to a flurry of sell-side fiscal headroom recalculations and bearish GBP trade idea publications. The headlines read awfully, with the ‘hole’ shift from £20bn to potentially nearer £40bn and the IFS report that each 1pp productivity downgrade could have a £7bn 2029/30 PSNB impact both frankly terrifying.

My belief is that there is some information in the market reaction not beginning at FT publication time (7pm 27/10/25], nor aggressively on the gilt market open the following day, but instead later in the session. I think there are technicals at play - both in the traditional sense i.e. EURGBP breaking the many intraday/week highs into the 0.8750/75 band - but also the mechanics of the vol market, whereby much like EURCHF, the multi-month consolidation and vol RV activity has resulted in a barrier-related more impulsive move, as delta books scramble to adjust quicker than market-makers had hoped to be able to act, mixed with a spec market that had A) decayed out of its short GBP core delta during the stagnant summer and B) actually began buying DNTs in EURGBP in recent weeks. The extent to which the EURGBP25dRR has aggressively shifted for GBP puts in the past 36hr (+0.50>+0.80), as well as the high levels of interest reported by banks, support the break-out hype logic.

My foundational thinking has two pillars. Pillar 1: Labour are floating trial balloons, as has been evidenced over the past two months; often with fairly disastrous content, which should serve to ‘ready’ both the market and the electorate with the worst case scenario, ultimately seeing a phase of relief into/over the Autumn Budget. A lot of money was made in 2022 on the Liz Truss ‘bond vigilante’ CCY+FI weakness cocktail, with the market ultimately breaking, however I believe this is unlikely to repeat. Pillar 2: This play for a GBP break lower would make more sense in a ‘high beta’ and ‘carry-unraveling’ fast market. I doubt whether the conditions we witness as I type (i.e. continued EM frenzy, high carry:vol ratios, equity ATH series’ and a stabilisation in the metals rout that had VaR-shock potential) will propel the theme. In this world, in which AUD thrives, GBP is often also on the pro-cyclical podium. Put simply, I believe one month is a very long time to await the 26th Nov announcement, paying for the privilege to hold the risk and with an already high bar for negative surprise just moving higher.

The prudence of limiting risk-taking or portfolio build-out amidst the US data drought and market catalyst absence of course dovetails with a mean-reversion bias, which i recognise can be dangerous, if this is regime change and I am wrong. I will therefore express this view in optionalised, limit-loss format and diversifying the CCY-specific expression slightly.

Trade expressions of choice:

Basket of GBP length with 1m expiry capturing November budget date:

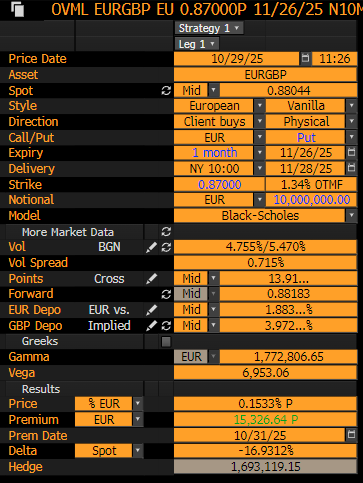

(50%) EURGBP (SR 0.8805) long 1m 0.87 put @ 0.15%

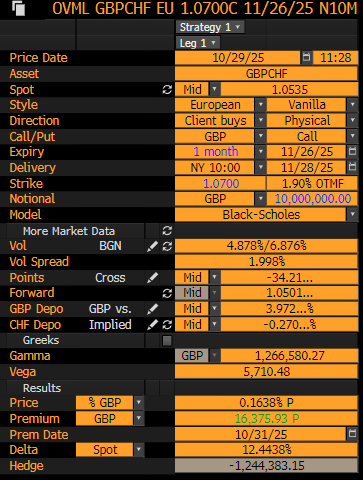

(50%) GBPCHF (SR 1.0535) long 1m 1.07 call @ 0.16%

Update [25/11/25]

Spent the day unwinding the GBPCHF 1.07 vanilla for an average of 25bp at SR 1.0652. The profit-taking is arriving late in GBPXXX but is warranted (and probably healthy for the structural multi-year shift lower), given how positioning had built into the event and the dislocation between the seemingly stretched CCY and some pretty nasty moves in gilts last week that would've usually seen aggressive accompanying GBP selling. Given that we have the EURGBP put into the event, happy to take the get-out-of-jail-free card in GBPCHF (1.0363 low during the AI meltdown!), as they become the same trade, the closer we have come to the UK budget, i.e. a relief delta. This outstanding (unhedged) EURGBP risk also supports the decision to sell a portion of this option, as opposed to trading the GBPCHF gamma, as the view (which remains) has always been for a GBP rally into/over the budget. Also feeding into the decision was my (GS endorsed, admittedly) opinion that the event weight was now too high for the event. Any gamma trading will only be done on a successful outcome: working a bid for 5mio EURGBP at 0.8700 and 5mio at 0.8625. Both feel ambitious!

Update [26/11/25]

EURGBP expires worthless. 0.8755 low.