Round Two

[18/12/25] [T]

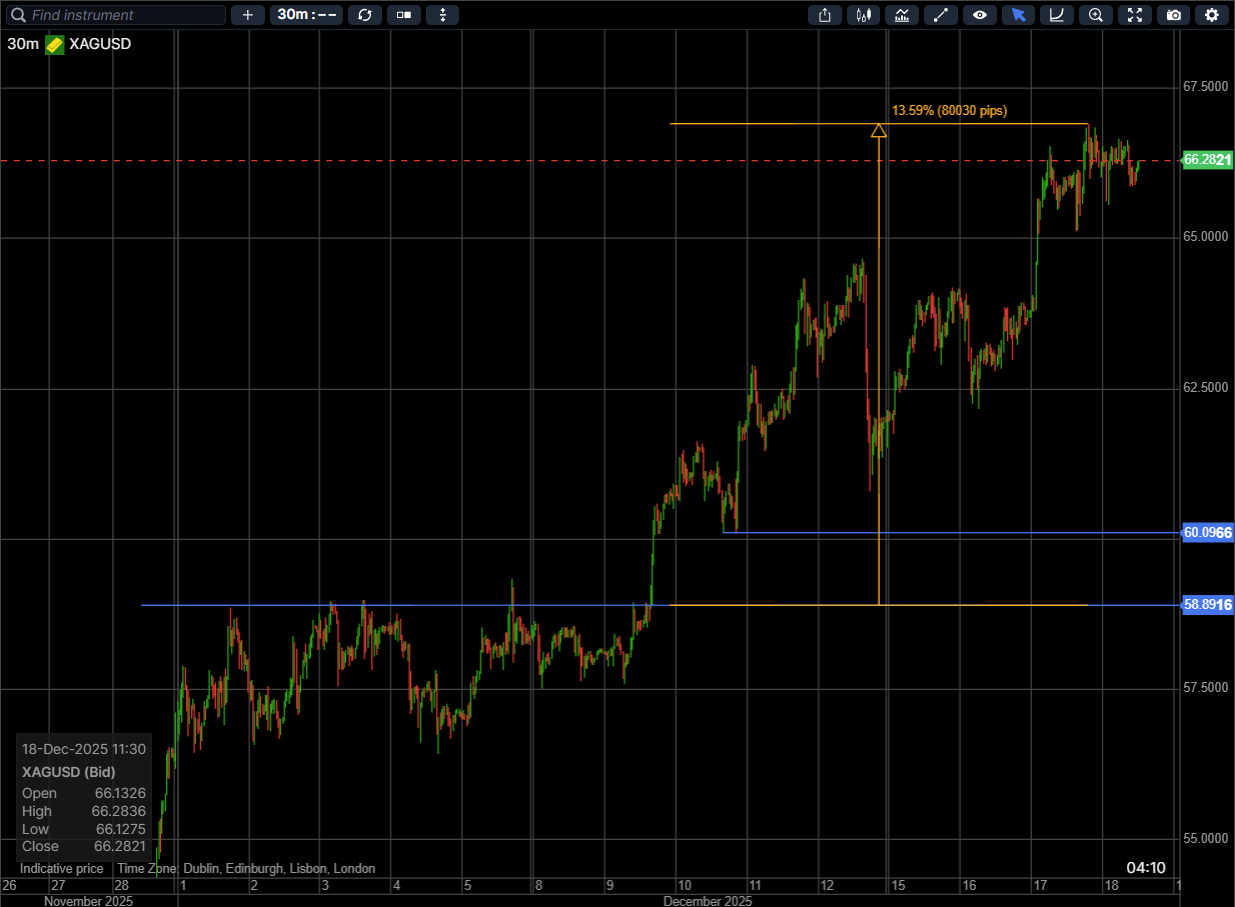

Since covering the silver short on Dec 5th, it has rallied a further 13.5%, taking it to +100% YTD. Astonishing stats - with the XAU parabolic comparables a little more digestible given it’s reserve status than XAG’s speculative/industrial properties. I spent yesterday curious as to why this runaway move was happening on a session during which US equities were suffering and some of the FX short USD ‘darlings’ were seeing a sharp unwind, catalysed originally by Trump’s EU tariff comments and hinting at broader deleveraging ahead of the US CPI print. I was hoping to see some degree of consolidation in XAG and before missing the train; I am going to call both an APAC & LDN session without a breach of the prior NY extremes just that. It’s a brave trade to short XAGUSD and this is nothing structural, but I feel there is good asymmetry to the view into the data, considering risk of a hot print and the standing start vs the dislocation with the other debasement basket trades yesterday - at least those that aren’t rates/steepener expressions (long SPX, short USD, long metals). Selling XAGUSD ahead of the NY open here (model/systematic open behind us and profit-taking into the looming US CPI event risk screening as good risk reward, as was seen through the sharp Friday PM sell-off).

Trade expression of choice:

Selling XAGUSD in 50% size at 66.30 with a 67.50 S/L. T/P at 63.00 Risking 1.8% to make 5%. (Beneath 65.00, where the futures volume accelerated yesterday, trail stop to entry)

Update [18/12/25]

TP on 50% of position pre-US CPI at 65.75. S/L on balance over data 66.85 yesterday’s high (synthesizes S/L @ entry)

Update [18/12/25]

Close position (balance at 65.40) on US cash equity open as earlier CPI print invalidates the catch-down logic above. Might be leaving money on the table, but feeling like the recalibration might be complete without the CPI beat.