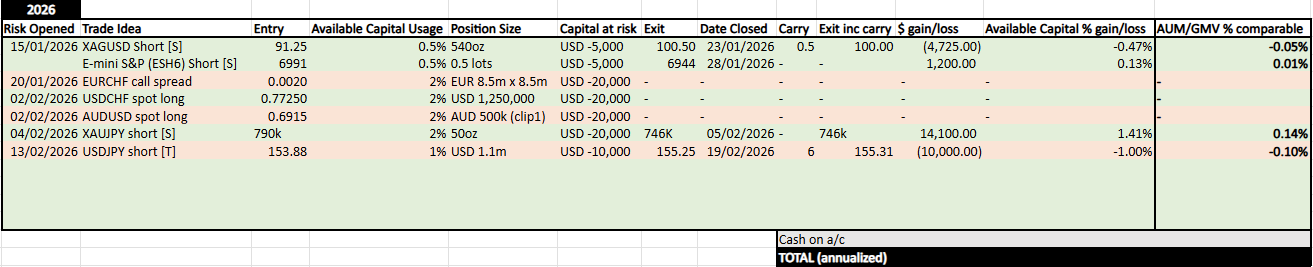

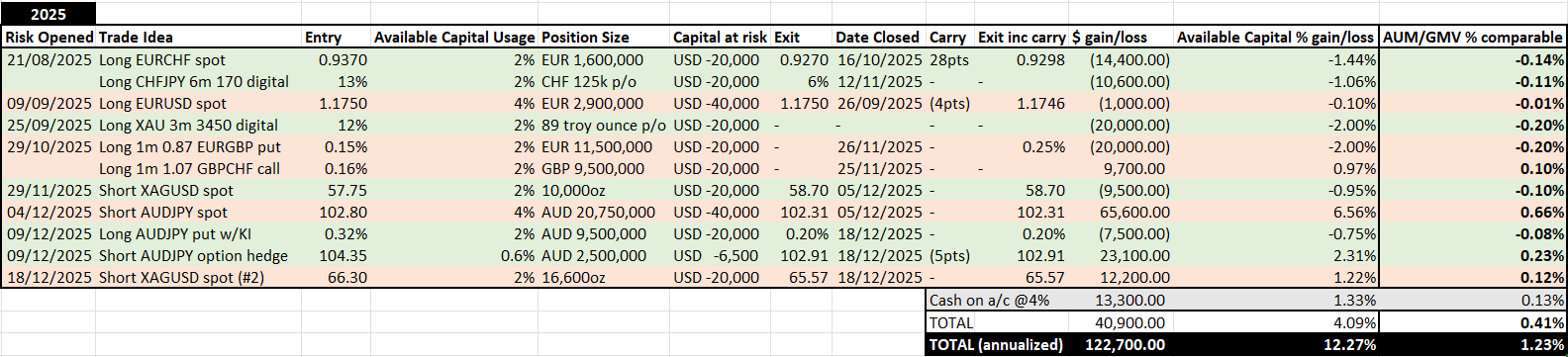

Available Capital Deployment

YTD Fund Performance (AUM/GMV Comparable)

2025 Summary

Win rate is poor (43%). The US Government Shutdown and lack of breakout/trend was tricky to trade; especially since I am a net vol buyer. Thankfully, downside management of options risk, slower initial cadence of ideas and preservation of risk:reward still resulted in a small gain over the four active trading months since launch. FX Vol has deteriorated since the Apr-Jun ‘glory days’ of 2025, which bodes well for the opportunity set into 2026.

Inclusion of Tactical as well as Structural ideas improved performance into year-end. This will continue into 2026 and I will clearly label each trade. Trading Metals as well as FX allowed for opportunity whilst FX was stagnant (albeit PM vol sufficiently high that I will continue to downsize these trades). No trades in rates, equity or commodity futures so far.

4% Available Capital usage per trade idea is too much, in hindsight. Halving to 2% for 2026. The risk-taking structure and process is otherwise working, with stop loss distance from entry defining the trade size, given the consistent capital deployment across ideas. As I am systematic with deployment size, I should be more dynamic with regards varying position size based upon MTM Available Capital. I won’t stretch as far as Kelly Criterion, but from now on I will reset the ‘amount deployed per trade’ at the end of each quarter, based upon YTD performance. This will ensure more risk is taken through a good year/less through a bad year.

I will continue to refine and share the process through 2026. The goal into 2027 will be to make the risk-taking more dynamic and categorise the risk into Breakout/Event/Carry Strategies with separate expected values and annual budgets, but I want 18 months of live track record before defining this, to continue shaping my process, (hopefully) growing the account and analysing the results.

* $1,000,000 Available Capital (i.e. $1m Stop Loss on Portfolio/$1m Margin Account with broker)

** 2% Available Capital ($20k) deployed per trade idea

*** Available Capital leveraged 10x for Fund AUM/GMV comparable (i.e. $10m Portfolio)