Goodbye, franc.

[21/08/25]

In a world that punishes central banks late to cut (Fed) and rewards those early in the cycle (ECB) from a currency standpoint, the swift and drastic lowering of the OCR by the Swiss National Bank to oh-so-familiar ‘zero bound’ territory has meant that the franc has thrived for the past 12 months (in fact, the past decade). The balancing act of lower local yields cementing the ‘funder’ status of the franc and the perennial need for market participants to view it as a haven (and to quickly ratchet up this exposure and happily pay the punitive carry during times of geopolitical disarray) has seen the latter win out. I view this balancing act - that has manifested in EURCHF coiling within a 0.9250/9450 range this summer - as being over. We now have two further weights on the CHF side of the scales:

A) The net effective U.S. tariff rate of c.18% (vs the terrifying 39% headline rate, assuming Pharma resolution in coming weeks and the continued exemption of gold tariffs)

B) The Trump-brokered ongoing Russia/Ukraine/Europe/US conversation, whilst difficult to track and harder to conclude, can see a sharp risk premium removal in EURCHF specifically. Both European restructuring multiplier effects and the direct impact of unfrozen Russian assets, which I suspect will benefit EUR more than it will benefit USD, gold and bitcoin, can see sustained EUR cross recovery.

It has been a while since negative domestic Swiss newsflow has been a driver of the currency. In fact, the last bout of sustained pressure on the franc and associated speculative activity was earlier in the cutting cycle through H1 2024. This low level of current positioning reinforces my view. Realised (thus implied) vol in XXXCHF is still incredibly low, and so the confluence of this view with the resultant well-defined spot levels in EURCHF, alongside cheaper option expressions in the other crosses is attractive. The kicker is that rate differentials in places are suggestive of a recalibration - see below CHFJPY chart of spot vs. the 6m forward rate - traditionally a better indicator of spot direction, yet recently diverging despite the SNB seemingly done with the OCR relapse and focusing on the FX intervention side of their mandate, whilst the BOJ face an entirely different issue of higher inflation, higher yields and perhaps the need to consequently embark upon an entirely unfamiliar hiking cycle themselves.

The risk is that I’m not identifying an early regime change, flagged by a 48hr U.S. tech stock/Reddit wall episode, or that I am underestimating the degree to which the market is pre-positioning for an end to the Russia/Ukraine conflict. That said; I’m expressing both in limited-loss format.

Trade expressions of choice (pricing references 8amLDN):

(50%) Long EURCHF spot 0.9370 (0.9600 T/P; 0.9270 S/L)

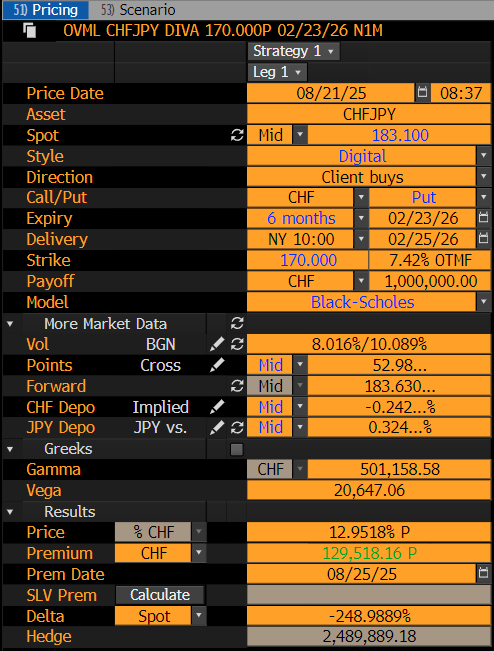

(50%) Long CHFJPY 6m 170 digital put @ 13% (spot reference 183.10)

Update [16/10/25]

EURCHF cash long stopped at 0.9270 in late London trading (again traded through the level on higher volume in Asia). Frustrating, given how resilient US equities have held-in during the NY time-zone and the beach-ball-esque price action beneath 0.93 once again. Given trade inception on 21/08/25, the position has benefited from -28pips of carry, improving the cash entry to 0.9342. The loss on the trade (allocated 2% of margin account) is therefore 0.77%. Keeping the CHFJPY digital and weathering the decay, given its Feb26 expiry and the even greater interest rate differential at current spot… although under no illusion that without the removal of Takaichi tail risk, this is unlikely to come back from the dead any time soon.

Elsewhere, happy to be taking it slow with the more structural ideas, given the macro uncertainty out there and the ongoing US data drought.

Update [12/11/25]

Unwind CHFJPY digital at 6%. Takaichi’s initial approval ratings surpass the backtested ‘new PM decay’ @ c.65%, she has not yet had to significantly dilute her fiscal promise and the BoJ’s independence remains in question, with no Dec BoJ leaks as of yet, nor anything other than MOF jawboning. Sensible to unwind this digital on the breach of the October highs in CHFJPY and key 154.50 resistance in USDJPY; from a capital preservation standpoint, if nothing else, as the view is stale. Loss on this portion of the trade is 53% of the premium spent i.e. -$10,600 in the Margin Account. The swap spread divergence remains but this is not a trade for now, clearly, ad was never intended to be a ‘wait for MOF intervention to get out of jail’ play.